The new Acquisition Regulation Comparator (ARC) is now live on Acquisition.gov.

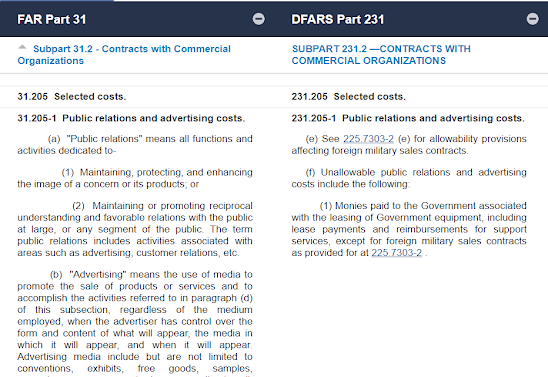

ARC provides users the ability to compare up to three regulations side by side. The results are displayed in a column layout, with regulations compared at the part/subpart level and lined up by the sections.

Its not quite finished however. Currently it contains the FAR, GSAR (GSA FAR Supplement), and DFARS (DoD FAR Supplement) but soon (they say) ARC will release all of the civilian agency acquisition regulations (e.g. NASA, DOE, etc).

ARC is easy to use - select the three regulations you want to compare, select the subpart, and then generate the comparison.

For example, if you have a DoD contract and want to research the cost principle on public relations and advertising (FAR 31.205-1), you need to understand not only the FAR coverage but also whether the DoD FAR supplement adds any additional restrictions on allowability. It does as you can see by this example:

This tool will save time when researching acquisition regulations and whatever FAR supplement is applicable. We hope the civilian agency supplements will be added sooner rather than later.