The Office of Federal Procurement Policy (OFPP) recently published the compensation cap for 2024. The new cap is $ 671,000 and represents a 3.87 percent increase over the 2025 compensation cap of $ 646,000.

These compensation caps apply to costs incurred during the calendar year, not the Government fiscal year.

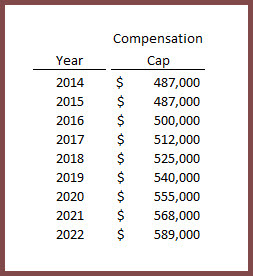

Following are the compensation caps by year:

Prior to 2014, compensation caps were applied variously to 'top five employees in management positions', and 'all employees' depending on the year and whether the contract was awarded by DoD/NASA or a civilian agency. Also, compensation caps prior to 2014 were much higher, peaking at $1.1 million in 2014. If you still have contracts awarded prior to June 24, 2014, you should become very familiar with FAR 31.205-6(p) to ensure accurate implementation of compensation caps.